- GF/ SF - Tejas, Opp Hotel Prasadalay, Shukrawar Peth, Pune - 411002

- +91 90 2132 2132

Difference Between Consignment and Sale: Choosing the Right Option

Have you ever wondered why certain businesses get to sell their products right away while some leave them in the stores without an immediate payout? That is the difference between a sale and a consignment. The latter one pays you immediately, which is the advantage of getting cash flowing immediately and reducing the risk of unsold inventory.

The other, while delaying your earnings, provides a chance to reach a wider audience, test market demand, and avoid the pressure of bulk purchasing by retailers.

There are certain parameters, such as cash flow, risk tolerance, and business objectives, which help you in deciding which option is better between the two. If you are looking for guaranteed returns in the fastest time possible, direct sales would probably suit you better.

On the other hand, if you want to strengthen your brand presence without hardly any upfront cost, consignment might be the medium to open a new venue. Understanding how each of these methods works should ensure that your decision will go well in regard to your long-term success.

What is a Sale?

Sales are transactions that directly involve the finances of a person or organization with the exchange of goods. Ownership is transferred to the buyer as payment is made by the seller. After the sale is completed, damages, loss, or resale of the product are at the risk of the buyer. On the other hand, it gives an immediate payment and a fixed amount to the seller, while the buyer takes the entire ownership without return obligations unless specific conditions apply.

The straightforward financial exchange characterizing the method renders it an option for businesses prioritizing immediate cash flow with minimal post-sale responsibilities.

Example of Sale

A bookstore sells a novel to a customer for $20. The customer pays immediately and becomes the owner of the book. The bookstore has no further obligation regarding that book.

What is Consignment?

Consignment is an arrangement where a consignor retains ownership of the goods until sold; he offers the goods to the consignee (either a retailer or a distributor) for sale. The consignee serves as an intermediary, garnering a commission on successful sales.

Payment is only done upon sale. Therefore uncertainty arises in revenue recognition. If the items do not sell, they are sent back to the consignor or kept for another sale. This mechanism would allow consignors to increase their reach into markets with minimal upfront risk, while the risk comes in unsold inventory.

Example of Consignment

A designer brings their clothing to a boutique on consignment. The boutique displays the clothes and sells them for a percentage of each sale. After a season, unsold clothes are returned to the designer.

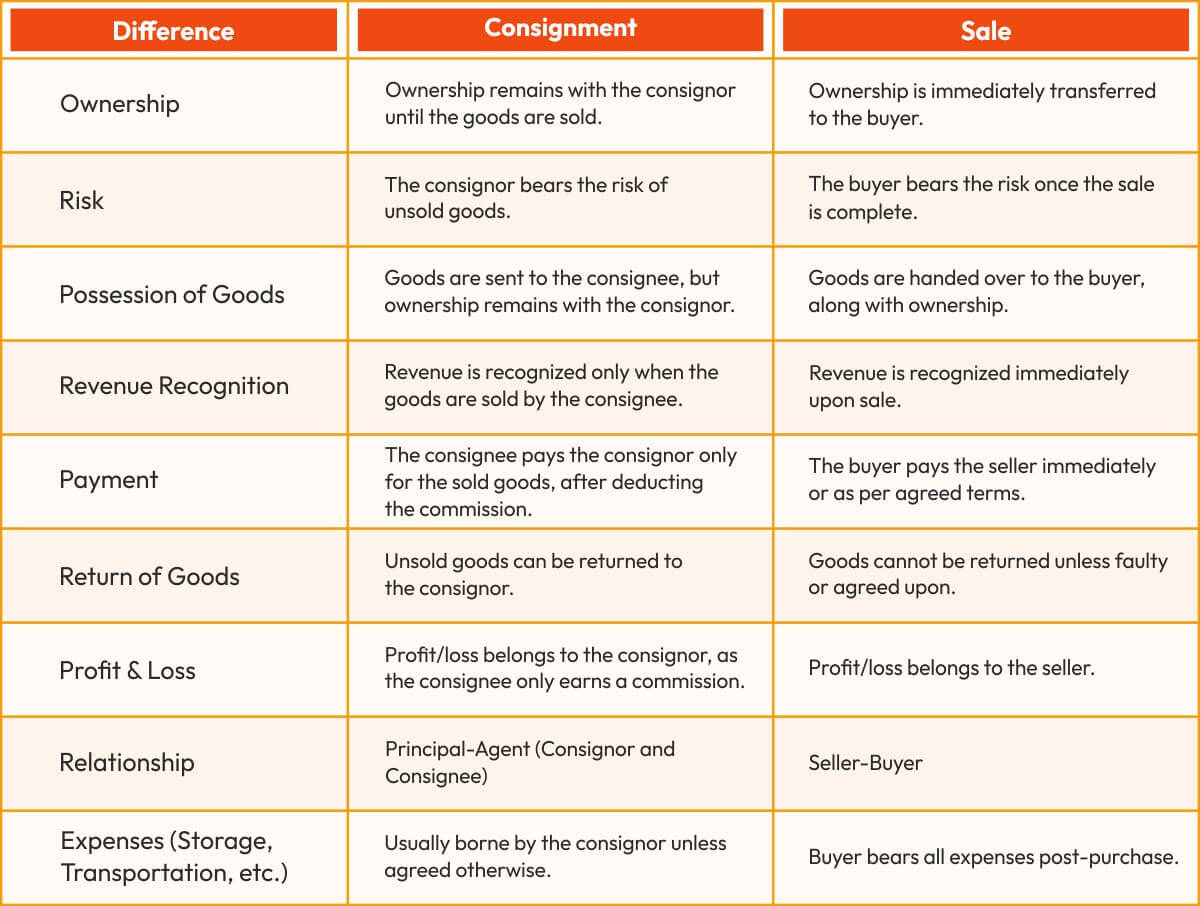

Difference between Consignment and Sale: A Comparative Chart

Choosing Between Consignment and Sale

The best method depends on the business model, type of product, and financial considerations. Some factors to consider:

- Cash Flow Needs : The immediate cash requirements can be fulfilled by opting to sell the product because it involves advanced payment to the seller, providing financial stability and liquidity without waiting for the product to be sold.

- Market Testing : Consignment shipping is the best way to test out the marketing of a commodity with negligible risk if you involve your product to reach customers without upfront investment.

- Product Type : Perishable items are often sold entirely to avoid spoilage. Unique items, especially expensive articles, are often sold on consignment until they reach the right buyers and maximize value.

- Risk Tolerance : Consignment selling would seem very interesting to those businesses that manage delayed payments, manage excess stock, and focus on marketing visibility rather than immediate revenue.

End note

Either consignment or sale will be preferable depending on your priorities: risk tolerance and cash flow. For someone needing ready cash and an immediate transfer of ownership, the sale is the best option.

On the other hand, if you plan to enter a market with minimal upfront risk, consignment can test demand and elevate brand awareness. Understanding the differences in these models allows a business to make decisions strategically, considering its long-term objectives and financial viability.